Pvm Accounting for Beginners

Table of ContentsNot known Facts About Pvm AccountingAn Unbiased View of Pvm AccountingThe Pvm Accounting DiariesPvm Accounting for DummiesAll About Pvm AccountingSome Known Details About Pvm Accounting Getting The Pvm Accounting To WorkLittle Known Facts About Pvm Accounting.

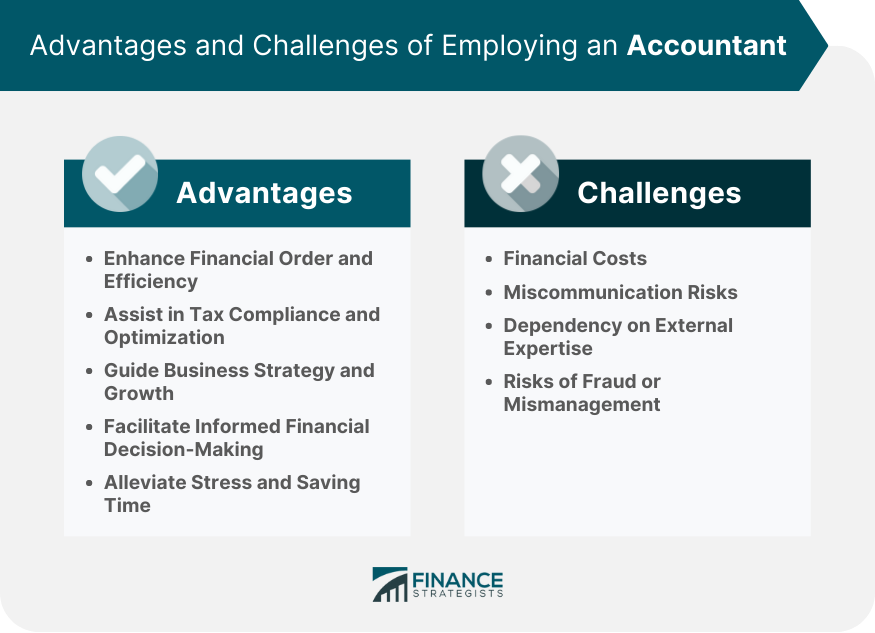

Running your business daily can conveniently eat all of your effective time as a local business owner. It can be frustrating to maintain total oversight of your funds, particularly if your firm is larger than a one-person procedure. A great accountant will assist you manage your venture's financial declarations, keep your publications tidy, and guarantee you have the consistent positive capital or get on the road to accomplishing it.However we strictly recommendations to individuals consult a licensed and expert monetary expert for any kind of type of investment you need. We just cover the financial investment and personal financing tips for info and instructional function below. They can also help instruct you topics such as just how to discover your financing cost on car loans to name a few subjects

They have an eye for earnings streams and can keep the financial structure in mint condition. They do not have the very same bias as buddies or household, and they are not intertwined with your business the way employees are. The distinction between money and accountancy is that audit focuses on the daily flow of cash in and out of a firm or establishment, whereas financing is a more comprehensive term for the administration of possessions and obligations and the preparation of future development.

Pvm Accounting Can Be Fun For Everyone

You could not need to utilize an accounting professional for every one of your economic needs. You can employ an accounting professional during the start-up phase and have them handle your yearly coverage, however collaborate with a bookkeeper to manage your books often. An accountant can additionally aid the service to monitor its economic efficiency and identify locations where it can enhance.

The requirements and treatments for becoming a Chartered Accountant vary depending upon the certain specialist body. It isn't called the gold manacles without good reason, and it's commonly located in city/stockbrokers who obtain a high income really swiftly. They purchase the brand-new residence, high-end car and participate in luxury vacations.

The Ultimate Guide To Pvm Accounting

As you can see, accounting professionals can aid you out during every phase of your firm's growth. That doesn't imply you have to hire one, yet the right accounting professional should make life much easier for you, so you can focus on what you love doing. A CPA can assist in taxes while additionally supplying clients with non-tax solutions such as auditing and monetary advising.

Working with an accountant decreases the chance of filing incorrect documentation, it does not entirely remove the possibility of human error impacting the tax obligation return. A personal accountant can assist you intend your retirement and likewise withdrawl.

9 Easy Facts About Pvm Accounting Described

This will certainly help you develop a company strategy that's practical, expert and more likely to prosper. An accountant is a specialist who supervises the monetary health and wellness of your organization, all the time. Every small company owner must take into consideration hiring an accounting professional before they in fact require one. Furthermore, personal accountants allow their clients to conserve time.

An accounting professional is qualified to ensure that your business abide by all tax regulations and company regulation, including complex ones that entrepreneur regularly neglect. Whichever accounting professional you pick, ensure they can provide you a sense of what their history and capacities are, and ask how they envision constructing a healthy and balanced monetary future for your business.

How Pvm Accounting can Save You Time, Stress, and Money.

Your accountant will also offer you a feeling of necessary startup costs and investments and can show you just how to keep working also in periods of lowered or negative money flow.

The smart Trick of Pvm Accounting That Nobody is Discussing

Running a local business can be an uphill struggle, and there are several elements to monitor. Declaring tax obligations and handling finances can be particularly challenging for local business owners, as it requires knowledge of tax codes and monetary policies. This is where a certified public accountant can be found in. A Licensed Public Accountant (CPA) can offer important support to local business owners and assist them browse the intricate globe of financing.

: When it comes to bookkeeping, bookkeeping, and monetary planning, a certified public accountant has the understanding and experience to help you make informed decisions. This proficiency can conserve small company proprietors both money and time, as they can depend on the CPA's knowledge to guarantee they are making the most effective economic selections for their organization.

CPAs are educated to remain current with tax obligation regulations and can prepare accurate and prompt income tax return. Clean-up bookkeeping. This can conserve little organization owners from migraines down the line and guarantee they do not face any type of penalties or fines.: A certified public accountant can also help small company proprietors with monetary planning, which involves budgeting and projecting for future development

Everything about Pvm Accounting

: A certified public accountant can additionally give beneficial insight and analysis for small company owners. They can help recognize locations where business is flourishing and areas that require improvement. Equipped with this info, small company proprietors can make adjustments to their procedures to optimize their profits.: Lastly, working with a CPA can give local business proprietors with satisfaction.

Additionally, Certified public accountants can provide support and assistance during financial situations, such as when the service deals with unforeseen expenses or a sudden drop in profits - Clean-up accounting. Working with a Certified public accountant for your small organization can give numerous benefits.

Doing taxes is every honest person's duty. Nevertheless, the federal government will not have the funds to supply the services we all trust without our tax obligations (https://www.bark.com/en/us/company/pvm-accounting/GOGlZ/). Because of this, everybody is urged to arrange their tax obligations prior to the due date to ensure they stay clear of penalties. It's additionally recommended due to the fact that you obtain benefits, such as returns.

Not known Factual Statements About Pvm Accounting

The size of your tax return relies on several elements, including your income, reductions, and credit reports. Therefore, working with an accounting professional is suggested because they can see whatever to ensure you get the maximum amount of cash. In spite of this, many individuals refuse to do so because they assume it's absolutely nothing greater than an unnecessary expense.

When you work with an accounting professional, they can aid you stay clear of these errors and ensure you obtain one of the most refund from your tax return. They have the understanding and experience to know what you're qualified for and just how to get one of the most refund. Tax period is typically a demanding time for any taxpayer, and for an excellent reason.

Comments on “How Pvm Accounting can Save You Time, Stress, and Money.”